Solar Tax Credit Increased To 30%, Extended To 2032

The Inflation Reduction Act of 2022 (IRA) was officially signed into law on August 16. This historic bill is the most significant federal climate and clean energy legislation ever enacted in the United States. The bill includes $369 billion in funding for clean energy and electric vehicle tax breaks, domestic manufacturing of solar panel and batteries, and pollution reduction.

As the name implies, this legislation will combat inflation by lowering energy costs. It will also provide economic opportunity and capacity-building investments in disadvantaged communities, create good jobs, and assist the United States in meeting President Joe Biden’s commitment to a 40% reduction in greenhouse gas pollution by 2030. The legislation will benefit every American in a variety of ways, but we’re especially excited about how it will affect you if you plan to go solar or have done so in the last year, want to electrify your home or transportation, or have children or grandchildren and are concerned about their future.

Everything in the bill excites, amazes, and energizes us, but let’s start with our favorite topic, solar!

Ten-year Investment Tax Credit Extension

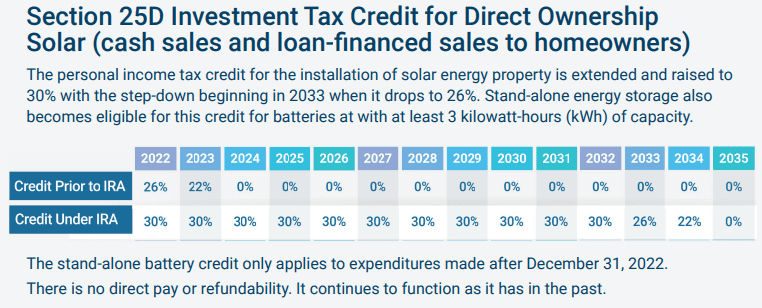

One of the most significant provisions of the bill is the extension of the federal Investment Tax Credit (ITC), and the restoration of the incentive amount to 30% through 2033. The ITC is widely regarded as the most effective climate policy in the United States, and extending it is a game changer.

Here’s an overview of the ITC extension, provided by the Solar Energy Industries Association (SEIA):

Retroactivity for Projects Completed in 2022

The 30% credit will be retroactively applied to anyone who installed their system this past year. Customers who had their Delta Solar systems operational after January 1, 2022, can file for their federal tax credit as usual and will receive a 30% credit instead of the previous 26% credit. Woohoo!

Carryover of the 30% Tax Credit Through 2032

If you do not have enough tax liability to use the entire credit in one year, you can carry it over for the next ten years. In 2033, your carryover will be 26%, and in 2034, it will be 22%.

Direct Payment for Tax-Exempt Organizations

Organizations that are tax-exempt will be eligible for a direct refund of the tax credit. This is fantastic news for schools, churches, government entities, and non-profits looking to go solar. Previously, tax-exempt organizations had to use a Power Purchase Agreement to take advantage of the tax credit, which meant they couldn’t own the panels themselves. They can now, and we are overjoyed to be able to provide an ownership option!

ITC for Storage

The bill includes a 30% storage tax credit, as well as a separate storage credit. This means that current solar owners would receive a 30% tax credit for adding battery storage to their current system.

Transferability

Beginning in 2023, entities will be able to transfer their tax credits to a third party, effectively allowing them to sell their tax credits for cash to unrelated parties. This is a positive step for individuals or businesses that do not have enough tax liability to take advantage of the tax credit.

The bill covers a lot more than solar, of course, but the solar package is a huge win for the solar industry, our company, and the everyday people who work tirelessly to build the renewable energy future. We will continue to research the legislation and provide updates as we learn more. But for now, let us raise a glass to this historic occasion!

If you’re a business owner interested in exploring the financial benefits and environmental impact of solar energy, reach out to us at Delta Solar, and let us help you discover the best solar solution for your company.