Solar energy is the way forward for businesses in Arkansas. As experts in commercial and agricultural solar installation, there are a few things we want you to know as you start considering going solar.

Many of the businesses we work with install solar for both environmental and financial benefits. Solar helps them on energy costs from the grid or even eliminate those costs entirely. It can also appeal to customers who appreciate businesses looking for more energy-efficient ways of providing goods and services.

How Solar Works

Solar 101

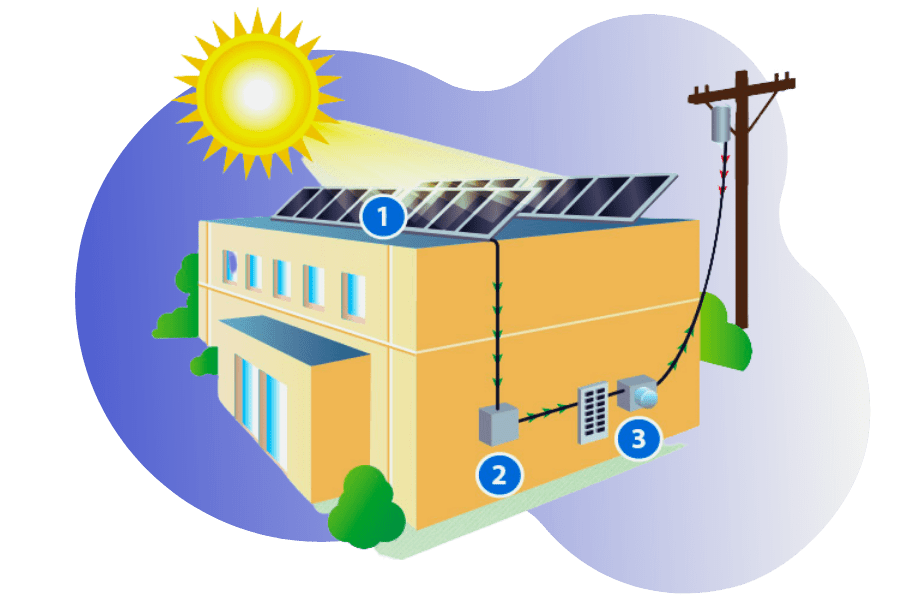

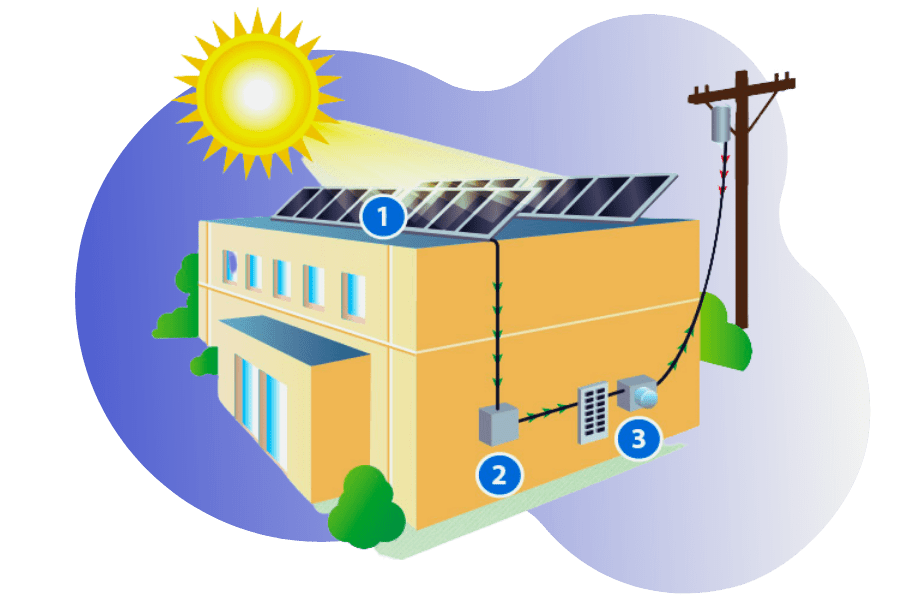

Let’s get back to basics. Solar energy systems generally are made up of several components: solar panels, inverters, battery storage options, and a bunch of wires.

Solar panels are made up of solar cells. Solar cells grab the sun’s rays and absorb their energy. That energy is sent to an inverter that can take the direct current generated by the solar panels and turn it into an alternating current we can use.

For businesses in Arkansas, often the best place to install solar panels is ground-mounted fields of solar panels. These solar fields can expand as far as your land does and can power multiple buildings if needed on the premises.

There is also rooftop solar for businesses with a large footprint of rooftop space, like warehouses and agricultural centers. Just like in a home installation, panels on the roof supply the energy needed to run the business—and can even look good while doing it.

That clean solar energy is sent to your business via the inverter so you can keep the lights on, the computers running, and your employees comfortable with necessary A/C or heating. Anywhere your business uses electricity, you can power it with solar.

Net Metering

You might be wondering what happens when the sun’s not out? Or there are many rainy days in a row where the sun can’t be seen? This is where net metering comes in!

Net metering is a big financial incentive for those choosing to go solar. It makes it possible for those generating their own energy to send any excess power back into the electrical grid. When this happens, your meter essentially runs backwards & the utility company will provide you with credits toward future energy bills.

Think of it as a piggy bank for your energy needs. In general, most properties with solar produce more electricity than they can use in the summer months and use more electricity from the grid in the winter. With net metering, you will build up extra credits in the summer months so that you can draw from them at night & in the winter months when you need them!

2. An inverter is a device that converts direct current (DC) into alternating current (AC) for use in the home.

3. The net amount of energy generated by the PV system is recorded by the utility meter. When you generate more electricity than you consume, your meter "spins backward," and the excess electricity is sent to the power grid. This helps to offset the cost of your electricity usage at night or on cloudy days when your system isn't producing power.

Generating Clean Energy and Big Savings for Your Business

In most places, the electric companies control how much you pay for energy from the electric grid. And often, you don’t have much choice of who you use. These rates and costs can rise every year without much notice. Going solar for your business is taking your power into your own hands, not only removing your dependence on the grid, but also freeing you from the unpredictable and ever-rising costs of traditional energy.

Tax Credits

Once you’ve decided on just how much solar your business will need, you can turn to the latest federal solar Investment Tax Credit (ITC). The ITC is a tax credit of up to 30% off the cost of your solar energy system, including equipment, labor, and permitting. This can significantly reduce the cost of going solar for your business and help you start saving from Day 1.

Depreciation

Another financial incentive for businesses is accelerated depreciation. The company that owns the solar array can depreciate the entire system cost less half of the ITC value (100% – 30% /2 = 85%). The value of depreciation varies depending on the company and its tax obligation, however, when the ITC and accelerated depreciation are combined, approximately half of the system cost is returned in tax benefits.

REAP Grants

The USDA’s Rural Energy for America Program (REAP) provides grants to agricultural producers and small businesses in rural areas to help them fund energy efficiency and renewable energy projects. These grants will pay up to 40% of the total cost of installing your solar system.

Even without it, Solar is a wonderful investment for many businesses, but a little extra support can’t hurt!

What You Need to Go Solar Today

There is a lot to consider when designing the perfect custom solar energy system for your business.

- Look at how much electricity you use every month based on your current bill

- Consider the space for your system and how much sun it gets. Are there any obstructions in the way of those rays, like trees or buildings?

- Think about how much you want to spend and what you will save.

For a comprehensive quote from an experienced solar installer, give us a call. With Delta Solar, your energy future is shining bright.